Residential Housing Newsletter #90

Welcome to the 90th issue of our WA residential housing newsletter! Let us know what you think about the new visuals.

Here's what happened this week:

Local

King County Housing Authority Pulls Back on Rental Assistance Funding

King County Housing Authority issues over 1,300 project-based vouchers, providing around $35 million in rental assistance per year. KCHA is pausing new commitments over worries about next year's federal budget.

(Seattle Times) (Archive)

City of Cle Elum Files for Bankruptcy to Settle $22 Million Judgment

The city of Cle Elum has filed for municipal bankruptcy protection, making it only the second city in WA history to do so, to settle a $22 million judgment against the city after a legal battle with a housing developer.

(NPR)

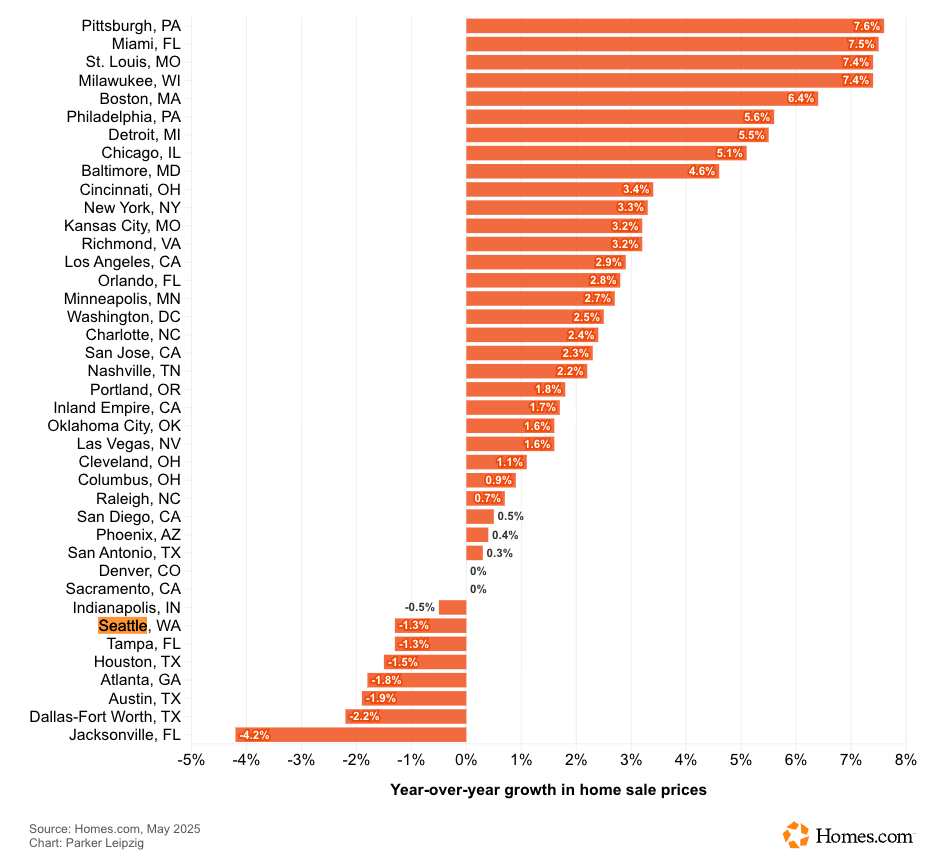

Puget Sound Home Prices Fall 1.3% in May 2025

The median home price in the Puget Sound metro area, including King, Pierce and Snohomish counties, dropped 1.3% year over year in May to $765,000, the region's first annual price decline in nearly two years.

(Homes.com) (Axios)

SDCI Schedules Only 2025 Landlord Workshop for Saturday, July 12

Seattle Department of Construction & Inspections is hosting the only Landlord Workshop of 2025 in person at Seattle City Hall in the Bertha Knight Landes Room on Saturday, July 11th from 10am to 3pm.

(SDCI)

Bellevue Mansion Lists for $79M, Priciest Property in the Northwest

A newly listed $79 million property in Bellevue is the most expensive estate on the Pacific Northwest market. The 16,284-square-feet home includes six bedrooms and 10 bathrooms, a pool, and a wine cellar.

(Seattle Times) (Archive)

PNW Multifamily Moves

Most Landlords Don't Verify Renter's Insurance

Know Your Landlord-Tenant Rights Webinar Series

Free webinar series hosted by Tacoma Housing Authority.

Presenters:

Jim Henderson, LandlordSolutions

Mark Morzol, Tacoma Pro Bono

July 22nd: Deposits and Fees

August 26th: 10-day Notices

September 16th: Pay or Vacate Notices + Tacoma Ordinance

October 21st: Screening + Order of Limited Dissemination

November 18th: Habitability Issues

Nation and World

Brooklyn Landlord Still Waiting on $200K in Back Rent

A landlord operating a rental property in Brooklyn's Park Slope neighborhood claims to be owed more than $200,000 in back rent from a tenant who hasn't paid since 2019. The rent is listed at $830 per month.

(The Sun)

Tennessee Wants to Tax Single-Family Rental Homes as Commercial Businesses

Tennessee's state government wants single-family rental homes reclassified from residential properties to commercial, which means rental properties would be assessed at 40% of their value instead of 25%.

(WKRN)

Higher Utility Bills For Apartments Likely After Trump Sustainability Rollbacks

Big changes and rollbacks to federal energy efficiency regulations and programs like Energy Star and the Low Income Home Energy Assistance Program may cause multifamily energy costs to rise.

(WKRN) (Archive)

Facing Costly Lawsuit, Berkeley Pauses Its Ban on Rent-Setting Algorithms

The cash-strapped city of Berkeley, CA postponed its recent ban on rent-setting algorithms several months after RealPage sued the city in federal court over claims that the ban violates constitutional rights.

(NPR)

Debate Rages in New York on Allowing Rent Increases for Rent-Stabilized Units

Landlords of NYC's one million rent-stabilized rental housing units may be allowed to increase rent again soon. The City's Rent Guidelines Board, which has allowed rents to increase 17% since 2014, will vote in July.

(New York Times) (Archive)

Opposition to Federal Land Sales Gains Steam

A proposal to sell between 2.2 million and 3.3 million acres of federally owned land across 11 states is facing increasing opposition from Republican lawmakers, making its passage less likely.

(Deseret News)

Compass Sues Zillow Over Privately Marketed Listings

Compass, one of the largest Real estate brokerage in the U.S., sued home-search website Zillow, accusing it of engaging in a conspiracy to maintain its dominance over digital home listings.

(CNN)

The American Starter Home is Shrinking

In 2024, the median size of a new single-family home in the U.S. shrunk to 2,150 square feet. That’s down from nearly 2,500 square feet in 2013 and close to the roughly 2,100 square foot average seen in 2009.

(Fast Company)